Top Guidelines Of Pvm Accounting

Top Guidelines Of Pvm Accounting

Blog Article

See This Report on Pvm Accounting

Table of ContentsHow Pvm Accounting can Save You Time, Stress, and Money.Not known Facts About Pvm AccountingThe 45-Second Trick For Pvm AccountingExamine This Report on Pvm AccountingRumored Buzz on Pvm AccountingAll About Pvm Accounting

Look after and take care of the development and approval of all project-related invoicings to clients to foster great interaction and avoid concerns. Clean-up accounting. Guarantee that ideal records and paperwork are submitted to and are updated with the internal revenue service. Make certain that the accounting process abides by the legislation. Apply needed building and construction bookkeeping standards and treatments to the recording and coverage of construction activity.Understand and maintain standard price codes in the bookkeeping system. Interact with various funding agencies (i.e. Title Business, Escrow Company) pertaining to the pay application process and demands required for payment. Take care of lien waiver disbursement and collection - https://www.kickstarter.com/profile/pvmaccount1ng/about. Display and solve financial institution concerns including cost abnormalities and examine differences. Help with executing and keeping inner financial controls and procedures.

The above declarations are planned to describe the basic nature and degree of work being carried out by people designated to this classification. They are not to be taken as an extensive listing of responsibilities, tasks, and abilities called for. Employees might be required to perform obligations outside of their normal responsibilities from time to time, as required.

The smart Trick of Pvm Accounting That Nobody is Talking About

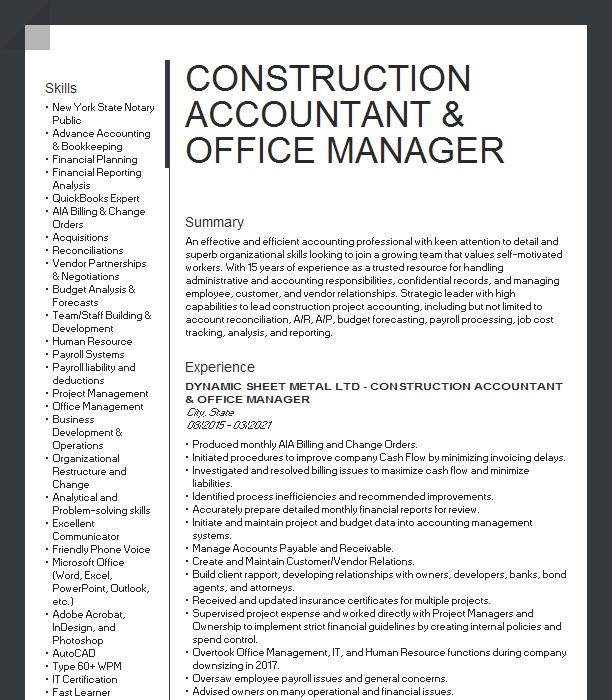

You will aid sustain the Accel group to ensure shipment of effective promptly, on budget plan, jobs. Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Building Accounting professional does a variety of bookkeeping, insurance coverage compliance, and project management. Works both individually and within specific departments to keep monetary documents and ensure that all documents are kept existing.

Principal obligations include, but are not restricted to, dealing with all accounting features of the firm in a timely and accurate fashion and offering records and routines to the firm's CPA Firm in the preparation of all monetary declarations. Makes sure that all audit procedures and functions are managed properly. Responsible for all economic documents, payroll, financial and daily operation of the bookkeeping function.

Prepares bi-weekly trial balance records. Works with Job Supervisors to prepare and upload all regular monthly invoices. Procedures and issues all accounts payable and subcontractor payments. Produces regular monthly recaps for Employees Compensation and General Liability insurance policy premiums. Generates regular monthly Job Expense to Date records and functioning with hop over to these guys PMs to reconcile with Job Managers' budgets for each project.

Pvm Accounting Fundamentals Explained

Efficiency in Sage 300 Building and Property (formerly Sage Timberline Office) and Procore building administration software an and also. https://www.pageorama.com/?p=pvmaccount1ng. Have to likewise be proficient in various other computer software application systems for the preparation of records, spreadsheets and other bookkeeping analysis that may be called for by administration. construction accounting. Should have strong business skills and ability to prioritize

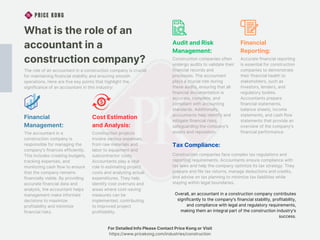

They are the monetary custodians that make sure that building and construction tasks continue to be on spending plan, comply with tax obligation guidelines, and maintain financial transparency. Building and construction accountants are not simply number crunchers; they are calculated companions in the building process. Their main duty is to take care of the financial facets of building and construction jobs, making certain that resources are allocated effectively and monetary dangers are lessened.

What Does Pvm Accounting Do?

By preserving a tight hold on job finances, accounting professionals help avoid overspending and economic troubles. Budgeting is a foundation of effective construction projects, and building and construction accountants are important in this regard.

Construction accounting professionals are fluent in these policies and make sure that the task conforms with all tax obligation needs. To stand out in the role of a construction accounting professional, people require a strong educational structure in accountancy and money.

In addition, qualifications such as Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Construction Sector Financial Expert (CCIFP) are highly related to in the sector. Construction tasks typically include tight target dates, altering guidelines, and unforeseen expenditures.

The Main Principles Of Pvm Accounting

Ans: Construction accounting professionals produce and keep track of budgets, recognizing cost-saving opportunities and making sure that the job remains within spending plan. Ans: Yes, building accountants handle tax obligation compliance for building and construction jobs.

Introduction to Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms need to make tough selections amongst lots of economic alternatives, like bidding on one job over another, selecting funding for products or tools, or setting a job's revenue margin. On top of that, building and construction is an infamously volatile sector with a high failure price, slow time to settlement, and inconsistent capital.

Production entails repeated processes with conveniently recognizable costs. Production requires different procedures, products, and equipment with varying expenses. Each job takes place in a brand-new location with differing website conditions and one-of-a-kind challenges.

Pvm Accounting - An Overview

Constant use of various specialized service providers and distributors affects effectiveness and cash flow. Repayment shows up in full or with routine repayments for the full agreement quantity. Some part of repayment might be withheld until task completion even when the professional's job is completed.

While traditional makers have the advantage of regulated atmospheres and enhanced manufacturing procedures, building and construction business must frequently adapt to each new task. Even somewhat repeatable projects need adjustments due to site problems and various other elements.

Report this page